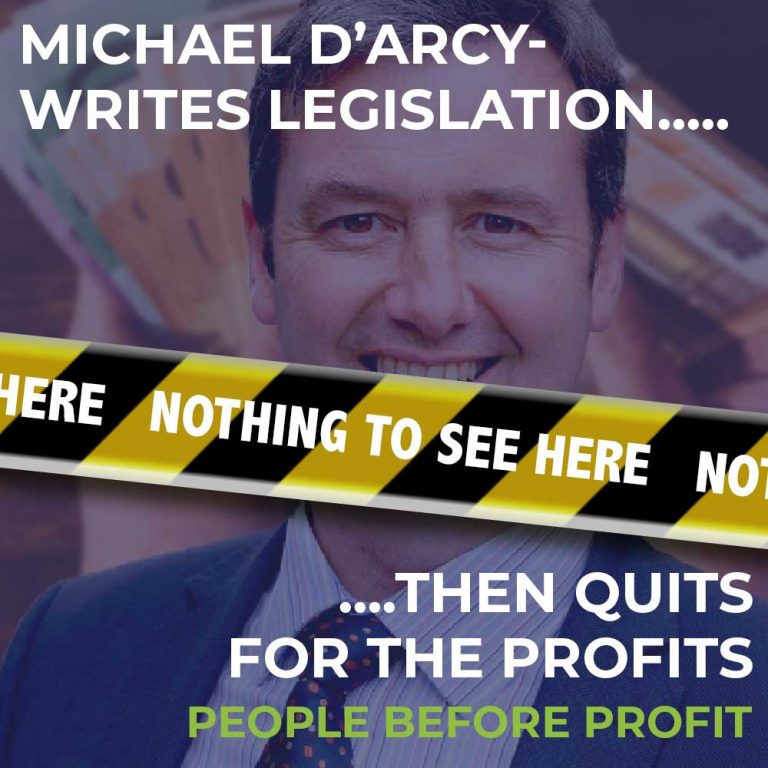

Few people take an interest in Alternative Investment Funds but the former Fine Gael Junior Finance Minister Michael D’Arcy did. He introduced the ‘Investment Limited Partnership Bill’ which met all the wishes of financial speculators.

He then went on to become the CEO of the Irish Association of Investment Managers, a lobby group that promotes their interests. He is receiving a six figure salary but the exact amount is not disclosed.

His Investment Limited Partnership Bill fell with the dissolution of the last Dail. D’Arcy then returned to politics briefly as a Senator and spoke in favour of the Bill when it returned . He claimed it was ‘boring’ and ‘technical’ but ‘we have to get through it’.

In other words, don’t look closely because it is none of your business.

In reality, the Bill is a speculators charter. Here are some of the benefits they get:

- There is only a limited disclosure on the beneficial owners of an investment fund. You have to hold 25% of the shares before registering with the Central Bank and they will give out only limited information.

- Funds are set up as a ‘partnership’ for US federal tax purposes, thus making it much more attractive to US taxable investors.

- The investment funds are ‘tax transparent’. This means they can get whatever tax concessions would to an underlying physical asset they are investing in.

- There is extensive ‘limited liability’. If you speculate and loose millions, others cannot go after your full fund.

- There are no Irish withholding taxes for non-residents from income earned.

Once again Fine Gael shows its true colours – the bankers party who looks after global speculators.